Flexible Endoscopes Market: Size, Share, and Competitive Landscape (2025-2032)

Flexible Endoscopes Market Size:

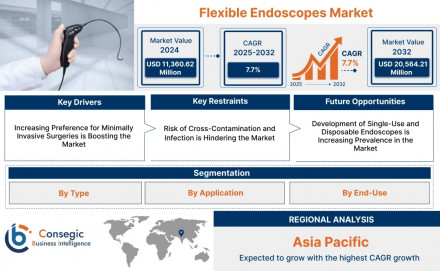

Flexible Endoscopes Market size is estimated to reach over USD 20,564.21 Million by 2032 from a value of USD 11,360.62 Million in 2024 and is projected to grow by USD 12,032.96 Million in 2025, growing at a CAGR of 7.7% from 2025 to 2032.

Flexible Endoscopes Market Overview:

The flexible endoscopes market has experienced robust growth over the past decade, fueled by the increasing prevalence of chronic gastrointestinal, respiratory, and urological disorders, along with the growing global geriatric population. The rising preference for minimally invasive diagnostic and surgical procedures has further accelerated market adoption. Hospitals and specialty clinics continue to dominate as key end-users. Moreover , rapid technological innovations - such as 4K ultra-high-definition imaging, AI-assisted diagnostics, and the growing availability of disposable (single-use) endoscope s- are reshaping the market landscape and enhancing patient outcomes.

Flexible Endoscopes Market Includes Drivers, Restraints & Opportunities

Key Drivers:

Rising Geriatric Population: The elderly are more prone to conditions requiring endoscopic evaluations (eg, colonoscopy for colorectal cancer), thereby driving market demand.

Increased Prevalence of Chronic Diseases: GI disorders, cancer, and pulmonary diseases necessitate frequent endoscopic interventions.

Technological Advancements: The integration of AI for detection assistance, high-definition imaging, and robotics are enhancing procedural efficacy and adoption.

Growing Preference for Minimally Invasive Procedures: Flexible endoscopes reduce recovery time, hospital stays, and patient discomfort.

Expanding Healthcare Infrastructure in Emerging Markets: Countries like India, Brazil, and China are investing heavily in medical infrastructure, boosting adoption.

Key Restraints:

High Cost of Devices and Procedures: The initial investment in advanced flexible endoscopes and maintenance can be prohibitive, especially for small healthcare facilities.

Risk of Cross-Contamination: Despite rigorous cleaning protocols, the risk of infection transmission remains a concern with reusable endoscopes.

Shortage of Skilled Professionals: Operating flexible endoscopes requires specialized training, which is lacking in underdeveloped regions.

Regulatory and Reimbursement Challenges: Varying approval standards and low reimbursement rates in some countries hindering market penetration.

Future Opportunities:

Emergence of Single-Use Flexible Endoscopes: Disposable scopes help reduce infection risk and are gaining popularity, especially post-COVID-19.

AI-Powered Diagnostic Assistance: AI integration is enhancing accuracy in detecting abnormalities, opening new horizons for market growth.

Expansion in Ambulatory Surgical Centers (ASCs): Increasing preference for outpatient procedures supports the need for portable and efficient flexible endoscopes.

Untapped Markets in Developing Economies: There's a vast opportunity for market expansion in Asia, Africa, and Latin America due to rising healthcare investments.

Flexible Endoscopes Market Competitive Landscape Analysis (Key Players)

Olympus Corporation (Japan)

Fujifilm Holdings Corporation (Japan)

Ambu A/S (Denmark)

Richard Wolf GmbH (Germany)

Becton, Dickinson and Company (BD) (USA)

HOYA Corporation (PENTAX Medical) (Japan)

Karl Storz SE & Co. KG (Germany)

Boston Scientific Corporation (USA)

Stryker Corporation (USA)

Medtronic plc (Ireland)

Flexible Endoscopes Market Industry Segmentation:

By Type

Video Endoscopes

Fiber Optic Endoscopes

By Application

Gastrointestinal Endoscopy

Bronchoscopy

Urology Endoscopy

ENT Endoscopy

Gynecology Endoscopy

Others

By End-Use

Hospitals

Ambulatory Surgical Centers

Specialty Clinics

Diagnostic Centers

Others

By Region

Asia-Pacific

Europe

North America

Latin America

Middle East & Africa

Regional Analysis of the Flexible Endoscopes Market:

North America: Dominates the global market due to robust healthcare systems, technological innovation, and a high volume of endoscopic procedures.

Europe: Strong market presence with key manufacturers, high awareness, and government support for early disease diagnosis.

Asia-Pacific: Fastest-growing region driven by rising healthcare spending, improving infrastructure, and large patient populations in countries like China and India.

Latin America: Growing steadily due to improved access to healthcare and rising medical tourism in Brazil and Mexico.

Middle East & Africa: Gradual adoption, supported by government initiatives to modernize healthcare but restrained by economic challenges in some regions.

Flexible Endoscopes Market Recent Developments:

2024: Olympus launched the EVIS X1 system with improved imaging and AI-enabled features for GI endoscopy.

2023: Ambu A/S expanded its single-use bronchoscope range to meet rising demand in intensive care and anesthesia.

2023: Fujifilm introduced Eluxeo Ultra, a video endoscopy system integrating AI-powered lesion detection.

Strategic Partnerships: Several key players are entering partnerships with software developers to integrate AI and cloud analytics into their endoscopy platforms.

Acquisitions: Boston Scientific's acquisition of endoscopy-focused startups to expand its portfolio of minimally invasive solutions.

Contact us:

Consegic Business intelligence Pvt Ltd.

Contact no: (US) (505) 715-4344

Email: sales@consegicbusinessintelligence.com