Low-Cost Satellite Market: Growth Trends and Forecast (2025-2032)

Low-Cost Satellite Market Introduction:

Low-cost satellites, also referred to as mini, micro, nano, or CubeSats, are space-bound systems developed at a significantly lower cost compared to traditional satellites. They are designed for specific missions such as earth observation, communication, technology demonstration, scientific research, and defense. The reduction in size, weight, and manufacturing costs allows for affordable access to space for commercial entities, research institutions, and even emerging space nations. With increasing technological advancements and private sector participation, the low-cost satellite market is rapidly evolving as a critical segment of the global space economy.

Low-Cost Satellite Market Overview:

The low-cost satellite market has seen exponential growth in recent years, fueled by increased demand for satellite-based services, innovations in miniaturization, and the surge in commercial space activities. These satellites are being deployed for diverse applications, including agriculture monitoring, disaster response, internet connectivity in remote areas, and surveillance. The emergence of new space start-ups and reduced launch costs—enabled by ridesharing and reusable rocket technologies—have made satellite deployment more feasible for non-traditional space actors. The market is competitive and fragmented, featuring aerospace giants as well as emerging players, with partnerships between governments and private enterprises further driving expansion.

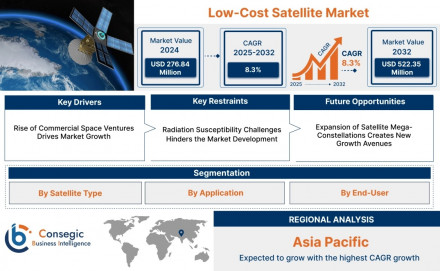

Low-Cost Satellite Market Size:

Low-Cost Satellite Market size is estimated to reach over USD 522.35 Million by 2032 from a value of USD 276.84 Million in 2024 and is projected to grow by USD 294.77 Million in 2025, growing at a CAGR of 8.3% from 2025 to 2032.

Low-Cost Satellite Market Includes Drivers, Restraints & Opportunities

Drivers:

- Technological Advancements: Improvements in miniaturization, power efficiency, and payload capacity are enhancing the functionality of low-cost satellites.

- Reduced Launch Costs: Innovations such as reusable rockets (e.g., SpaceX Falcon 9) and satellite rideshare missions have made launching small satellites more economical.

- Growing Demand for Data Services: Increased use of satellites for telecommunications, remote sensing, and navigation is boosting market demand.

- Increased Private Sector Involvement: Government deregulation and funding incentives have encouraged private investments and start-ups to participate in satellite manufacturing and deployment.

- Global Connectivity Initiatives: Projects aiming to bridge the digital divide (e.g., Starlink, OneWeb) rely heavily on low-cost satellite constellations.

Restraints:

- Limited Payload and Lifespan: Low-cost satellites have smaller payload capacities and shorter lifespans, limiting their utility for long-term or high- demand missions.

- Space Debris and Congestion: Increased satellite launches contribute to orbital congestion and raise the risk of space debris, which can damage existing satellites.

- Regulatory and Licensing Challenges: Navigating international space law, frequency allocation, and national licensing remains complex and time-consuming.

- Limited Power and Communication Bandwidth: Miniaturized systems often struggle with power limitations, impacting the volume and quality of data transmitted.

Opportunities:

- Emerging Markets Participation: Developing countries are increasingly adopting small satellite solutions for cost-effective access to space-based technologies.

- Satellite Constellations: Growing interest in deploying large constellations for broadband internet, weather monitoring, and disaster management presents robust opportunities.

- Earth Observation and Agriculture: Precision farming, climate tracking, and natural resource management can benefit from frequent, low-cost satellite-based imaging.

- Defense and Surveillance: Governments are investing in low-cost satellite constellations for national security and border monitoring applications.

- Education and Research: Universities and academic institutions are launching CubeSats for scientific research, promoting educational access to space.

Low-Cost Satellite Market Competitive Landscape Analysis (Key Players)

- SpaceX (USA)

- OneWeb (UK)

- Thales Alenia Space (France)

- Surrey Satellite Technology Limited (SSTL) (UK)

- Astrocast (Switzerland)

- Planet Labs (USA)

- Rocket Lab (USA)

- Blue Canyon Technologies (USA)

- AAC Clyde Space (Sweden)

- Sierra Nevada Corporation (USA)

Low-Cost Satellite Market Industry Segmentation:

By Satellite Type

- Nano Satellites

- Micro Satellites

- Mini Satellites

- CubeSats

- Others

By Application

- Communication

- Earth Observation

- Navigation

- Scientific Research

- Remote Sensing

- Others

By End-Use

- Commercial

- Government

By Region

- Asia-Pacific

- Europe

- North America

- Latin America

- Middle East & Africa

Regional Analysis of the Low-Cost Satellite Market:

- North America: Dominates the market due to the presence of key players like SpaceX, high R&D investment, and government contracts (e.g., NASA, DoD).

- Europe: Rapid growth driven by ESA initiatives and private firms like OneWeb and SSTL.

- Asia-Pacific: Fastest-growing region with emerging players in India (ISRO, Pixxel), China, and Japan focusing on both governmental and commercial missions.

- Latin America & Middle East: Gaining traction as countries invest in space programs and partnerships to enhance communication and monitoring capabilities.

- Africa: Early-stage market; gaining momentum through international collaborations and use of satellites for education, disaster response, and agriculture.

Low-Cost Satellite MarketRecent Developments:

- 2024: SpaceX continued rapid Starlink deployment, surpassing 6,000 operational satellites.

- 2024: ISRO launched multiple CubeSats through its PSLV-C58 mission, marking growing Indian commercial space activity.

- 2023: Planet Labs expanded its Earth observation fleet with new SuperDove satellites, offering high-frequency imaging.

- 2023: Rocket Lab introduced the HASTE suborbital variant for hypersonic and defense missions.

- 2023–2025 Outlook: Expected surge in small satellite launches with multiple governments and private firms planning large constellations for broadband internet and IoT services.

Contact us:

Consegic Business intelligence Pvt Ltd.

Contact no: (US) (505) 715-4344

Email: sales@consegicbusinessintelligence.com