Early Production Facility Market Application Segments and Demand Analysis (2025-2032)

Early Production Facility Market Size:

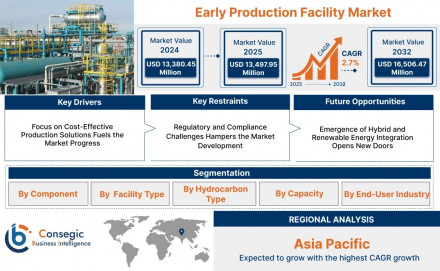

Early Production Facility Market size is estimated to reach over USD 16,506.47 Million by 2032 from a value of USD 13,380.45 Million in 2024 and is projected to grow by USD 13,497.95 Million in 2025, growing at a CAGR of 2.7% from 2025 to 2032.

Early Production Facility Market Overview:

The Early Production Facility market is experiencing steady growth, primarily driven by the exploration of new oil & gas fields, especially in remote and offshore locations. EPFs are highly beneficial in uncertain economic conditions as they reduce capital expenditure and provide operational flexibility. Moreover, the market is witnessing increased adoption in both onshore and offshore environments due to modular design, faster deployment timelines, and cost advantages. The EPF market caters to both greenfield and brownfield projects and is dominated by service providers offering integrated engineering, procurement, and construction (EPC) solutions.

Early Production Facility Market Includes Drivers, Restraints & Opportunities

Key Drivers:

Rapid Monetization of Discoveries: Oil and gas companies prefer EPFs to quickly generate revenue while awaiting the completion of permanent infrastructure.

Increased E&P Activities: Expanding exploration and production activities in Africa, the Middle East, and South America are creating a strong demand for EPFs.

Cost-Effectiveness: Compared to full-scale production facilities, EPFs require lower capital investment and offer quicker ROI.

Remote and Harsh Environments: EPFs are ideal for early-stage field development in remote locations with limited infrastructure.

Technological Advancements: Innovations in modular design, automation, and remote monitoring have enhanced the efficiency and scalability of EPFs.

Key Restraints:

Environmental Concerns: Emissions, flaring, and potential spills associated with oil and gas processing raise environmental and regulatory concerns.

Volatility in Crude Oil Prices: Fluctuations in oil prices affect investment decisions, particularly in marginal or high-cost fields where EPFs are often used.

Operational Limitations: EPFs are typically designed for short to medium-term use and may not handle the full production capacity over the life of a field.

Regulatory Delays: Permitting and regulatory approvals can delay EPF deployment, especially in environmentally sensitive areas.

Future Opportunities:

Unconventional Oil and Gas Development: Growth in shale gas and tight oil plays presents an opportunity for EPFs to be used in pilot projects or temporary production setups.

Digitalization and Automation: Integration of smart sensors, predictive maintenance, and AI-driven monitoring can significantly improve efficiency and reduce downtime.

Emerging Markets: Countries in Africa and Asia-Pacific with untapped hydrocarbon reserves present lucrative opportunities for EPF deployment.

Floating Production Solutions: Offshore developments in deepwater and ultra-deepwater areas are increasingly turning to floating early production systems, expanding the market scope.

Early Production Facility Market Competitive Landscape Analysis (Key Players)

Schlumberger Limited (USA)

Halliburton Company (USA)

Pyramid E&C (UAE)

Frames Group (Netherlands)

OilSERV (UAE)

TechnipFMC plc (UK)

Saipem S.p.A. (Italy)

Petrofac Limited (UK)

Expro Group (UK)

TETRA Technologies, Inc. (USA)

Early Production Facility Market Industry Segmentation:

By Component

Separators

Heat Exchangers

Compressors

Pumps

Flare Systems

Others

By Facility Type

Onshore Early Production Facilities

Offshore Early Production Facilities

By Hydrocarbon Type

Crude Oil

Natural Gas

Condensates

Others

By Capacity

Up To 10,000 Bopd

10,001 - 30,000 Bopd

30,001 - 50,000 Bopd

By End-Use Industry

Oil & Gas

Energy & Power

Petrochemical

Others

By Region

Asia-Pacific

Europe

North America

Latin America

Middle East & Africa

Regional Analysis of the Early Production Facility Market:

North America: The region is a leading adopter of EPFs, driven by shale exploration in the U.S. and Canada. Demand is focused on short-cycle projects and cost-efficient production.

Middle East & Africa: High growth is expected due to increased E&P activities, especially in Nigeria, Angola, UAE, and Saudi Arabia. EPFs are used to develop marginal fields and provide early returns.

Asia-Pacific: Countries like India, China, and Indonesia are investing in domestic energy production, creating a strong market for EPFs.

Latin America: Brazil and Argentina show promise due to offshore pre-salt developments and Vaca Muerta shale play.

Europe: The North Sea region continues to rely on EPFs for extended field development and satellite tie-backs, though the market is relatively mature.

Early Production Facility Market Recent Developments:

April 2024 – Expro Group announced the successful deployment of a high-capacity EPF in Nigeria, helping to monetize offshore reserves rapidly.

January 2024 – Schlumberger partnered with an African NOC to deliver modular EPF systems tailored for flaring reduction and emission control.

October 2023 – Petrofac secured a contract in Oman for designing and operating an EPF for a new onshore oil block.

July 2023 – TETRA Technologies launched a new skid-mounted EPF design optimized for faster deployment and enhanced safety in extreme weather conditions.

May 2023 – Halliburton introduced a digital twin-enabled EPF monitoring solution to improve operational reliability and reduce maintenance costs.

Contact us:

Consegic Business intelligence Pvt Ltd.

Contact no: (US) (505) 715-4344

Email: sales@consegicbusinessintelligence.com