Acaricides Market Pricing Analysis and Competitive Landscape (2025–2032)

Acaricides Market Size:

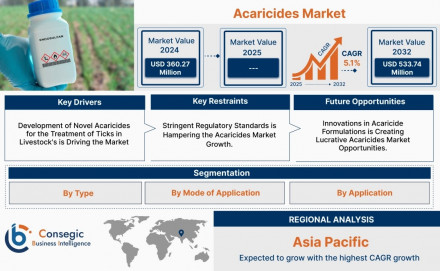

Acaricides Market size is growing with a CAGR of 5.1% during the forecast period (2025-2032), and the market is projected to be valued at USD 533.74 Million by 2032 from USD 360.27 Million in 2024.

Acaricides Market Introduction:

Acaricides are chemical agents specifically formulated to kill mites and ticks, which are parasitic pests affecting crops, livestock, pets, and humans. These pesticides are used across several sectors, including agriculture, animal husbandry, horticulture, and public health. The rising infestation of ticks and mites due to changing climatic conditions and intensive farming practices has led to increased dependence on acaricides. These products can be organic or synthetic in nature and are available in different forms such as sprays, powders, and dips. The acaricides market plays a critical role in supporting food production and improving animal health by controlling vector-borne diseases and enhancing productivity.

Acaricides Market Overview:

The global acaricides market has been witnessing steady growth and is projected to expand at a moderate compound annual growth rate (CAGR) over the forecast period (2025–2032). Key growth factors include increasing demand for agricultural productivity, stringent pest control regulations, and heightened awareness of veterinary health. The market is segmented by type (organophosphates, pyrethroids, carbamates, and others), application (agriculture, animal husbandry, industrial, and domestic), and form (liquid, solid, spray). Technological advancements in pest control formulations and the shift toward integrated pest management (IPM) practices are also shaping the industry landscape. The market is competitive, with both multinational agrochemical companies and regional players actively innovating in product development.

Acaricides Market Includes Drivers, Restraints & Opportunities

Drivers:

Rising Crop Damage Due to Mites: Mites are responsible for significant yield losses in crops like cotton, fruits, and vegetables, necessitating the use of acaricides.

Increase in Livestock Farming: With the growing demand for dairy and meat products, the need for animal health management, including tick control, is surging.

Climate Change: Warmer and wetter climates are leading to the proliferation of mite and tick populations, expanding the need for acaricides globally.

Government Initiatives: Governmental support in the form of subsidies and pest control programs encourages farmers to adopt acaricides.

Technological Innovation: Development of novel formulations with enhanced efficacy, extended residual effects, and lower toxicity is further propelling the market.

Restraints:

Health and Environmental Concerns: The excessive and improper use of chemical acaricides can lead to environmental pollution and health risks, limiting market expansion.

Stringent Regulatory Frameworks: Regulatory authorities are enforcing strict approval processes and bans on toxic substances, which can delay product launches.

Resistance Development: Prolonged use of the same acaricide can result in the development of resistance in mite and tick populations, reducing effectiveness.

High R&D Costs: Developing new, safer acaricides requires significant investment in research and testing, which can be a barrier for new entrants.

Opportunities:

Organic and Bio-based Acaricides: Increasing demand for eco-friendly alternatives is paving the way for bio-based and plant-derived acaricides.

Expansion in Emerging Economies: Growing agricultural activities and livestock farming in countries like India, Brazil, and Indonesia present untapped market potential.

Integrated Pest Management (IPM): Rising adoption of IPM techniques in sustainable agriculture opens avenues for safer, multi-action acaricides.

E-commerce Penetration: The growing trend of online agri-product sales enables better market reach for acaricide manufacturers.

Acaricides Market Competitive Landscape Analysis (Key Players)

BASF SE (Germany)

Bayer AG (Germany)

NuFarm (Malaysia)

NIPPON SODA CO., LTD (Japan)

Nissan Chemical Corporation (Japan)

CERTIS BELCHIM (United States)

Sumitomo Chemical Ltd. (Japan)

Arysta LifeScience (Japan)

Peptech Biosciences Ltd. (Australia)

Corteva (United States)

Acaricides Market Industry Segmentation:

By Type

Synthetic

Organophosphates

Pyrethroids

Neonicotinoids

Organochlorines

Others

Biobased

Microbial

Botanical

Others

By Mode of Application

Building Materials

Ceramics & Glass

Fertilizers

Semiconductor

Others

By Application

Agriculture

Wood Preservation

Veterinary Medicine

Others

By Region

Asia-Pacific

Europe

North America

Latin America

Middle East & Africa

Regional Analysis of the Acaricides Market:

North America: A mature market driven by large-scale agricultural practices and advanced veterinary care. The U.S. leads in innovation and product development.

Europe: Growth is driven by stringent regulations and increasing adoption of eco-friendly acaricides. Countries like Germany and France are significant contributors.

Asia-Pacific: Expected to witness the highest growth rate due to expanding agriculture, increasing awareness about animal health, and government support. India and China are key markets.

Latin America: Agricultural economies like Brazil and Argentina drive demand for acaricides, especially in cash crops.

Middle East & Africa: Gradual market development driven by livestock health concerns and climate-induced pest issues.

Acaricides Market Recent Developments:

Bayer AG recently launched a new line of acaricides that are safer for beneficial insects, aligning with sustainable farming goals.

Syngenta introduced an advanced formulation with extended residual activity and faster knockdown effect for mites in greenhouse crops.

Merck Animal Health has expanded its product line in Asia, targeting tick-borne disease control in livestock.

Strategic acquisitions and collaborations are on the rise, such as FMC’s partnership with biotech firms to develop next-gen bio-acaricides.

Digital platforms and precision agriculture technologies are being integrated for more effective acaricide application and resistance management.

Contact us:

Consegic Business intelligence Pvt Ltd.

Contact no: (US) (505) 715-4344

Email: sales@consegicbusinessintelligence.com